Welcome to our collection of articles exploring the financial landscapes of various industries and professions. From Victoria's Secret Fashion Show to Major League Baseball, we delve into salaries and earnings that define these sectors.

Learn about take-home pay of NFL and NBA players, financial dynamics of Uber and UberEats, income disparities in different medical professions, pay structures in schools, earnings of TV's highest-paid actors and more:

-

A breakdown of Major League Baseball player and front office salaries

-

Actual take-home pay for NBA's highest-paid players

-

Current and historical salary figures for the President and other federal government leaders

-

Examining the Different Ways Doctors Get Paid

-

Fares, Driver Pay and the Financial Side of Uber

-

Fees, earnings and the financial side of UberEATS

-

How Much Money Does the Average NFL Player Take Home?

-

How Private, Public, and Charter Schools Pay Teachers

-

Let's explore the payrolls of the Clinton and Trump campaigns

-

The Highest-Paid TV Actors by Episode

-

The money and salaries behind the PGA and professional golf careers

-

The money and salaries behind the Victoria's Secret Fashion Show

-

What are the highest-paid professions in 2018?

A breakdown of Major League Baseball player and front office salaries

Major League Baseball has seen a mixed bag in terms of salary growth over the past 30 years. While average player salaries have grown by leaps and bounds, front office job growth has varied depending on position and demand.

Here’s a closer look at MLB salaries for players and office staff.

On the Field

For MLB players, the average salary is a staggering $4,097,122 a number that passed the $4 million mark for the first time in 2017. That’s about 3.3% growth over the previous year.

Baseball’s highest-paid player, as of 2018, is Los Angeles Angels MVP Mike Trout at just over $34 million. He’s followed closely by Clayton Kershaw at $33 million and Zack Greinke at $32 million. Miguel Cabrera, David Price, and Jake Arrieta tie for fourth place at $30 million.

The full list of MLB player salaries includes 8 players at $0 and 4 players at the major league minimum salary of $545,000.

MLB Managers

The MLB doesn’t officially release coaches’ salaries, but many sports experts guess and rank them. It’s generally thought that Joe Maddon, Mike Scioscia, and Bruce Bochy make the most, at $5 million each. Joe Girardi, Buck Showalter, and Don Mattingly follow at $4 million, $3.5 million and $2.5 million.

The lowest-paid MLB manager probably makes around $750,000, but it’s hard to know for sure. Some stats experts simply put 20 or more coaches into the “unknown” category because there’s no reliable record of their salaries.

Front Office Averages

Getting your first spot in the MLB front office isn’t easy, and might not come with top pay. Interns generally make about $11 an hour. A study of 128 MLB team executives found that starting salaries ranged from $20,000 to $35,000.

Management jobs within MLB staff pay around $65,000 on average, and employees who reach the level of director earn about $105,000. A vice president earns about $165,000 and a senior vice president can bring in upwards of $300,000.

About 9 out of 10 MLB presidents and CEOs made more than $400,000 last year. Some top-tier executives also make more than $400,000 in jobs like executive vice president or roles where they hold multiple titles.

Examples of Front Office Salaries

Outside of the top management positions, the overall average of MLB front office salaries is $60,000 a year. Here are some examples of salaries at various MLB office jobs, from lowest to highest-paying.

- Office assistant: $36,000

- Customer service representative: $37,000

- Video editor: $39,000

- Tech support specialist: $40,000

- Editorial producer: $41,000

- Administrative assistant: $43,000

- Office administrator: $48,000

- Senior records coordinator: $53,000

- Legal assistant: $55,000

- Special events coordinator: $55,000

- Conference center manager: $57,000

- Broadcast engineer: $61,000

- Assistant to the vice president: $68,000

- Marketing producer: $73,000

- Senior visual designer: $83,000

- Crew chief: $85,000

- Director of security: $85,000

- Senior QA engineer: $85,000

- Web producer: $85,000

- Marketing director: $88,000

- Director of customer service: $95,000

- Camera operator: $96,000

- Equipment services manager: $103,000

- Assistant director: $111,000

- Director of operations: $116,000

- Advertising consultant: $125,000

- Accounting manager: $125,000

- Product manager: $126,000

- Senior director: $136,000

- IT manager: $138,000

Looking for more helpful salary information? Stop by the Complete Payroll blog or contact us for HR and payroll expertise.

The salaries of the top 5 highest paid NBA players all have 2 commas and a whole lot of zeros. We all know that NBA players earn some serious bank. What we don't know are the specifics. Your Google search for the “Highest Salaries of the NBA” might show you how much these players signed contracts for, but those numbers probably don't reflect how much money they actually take home.

The published and highly publicized salaries of the top NBA players do not account for agency fees, federal, state and city taxes, as well as other various deductions.

So, how much do these NBA stars actually take home? We found a really interesting article from ESPN that shows the take-home pay of the highest-paid NBA players after all the deductions come out. You can find that article here. But being the (sometimes nerdy) payroll people that we are, we of course wanted to dive a little deeper into it...

Deduction Breakdown

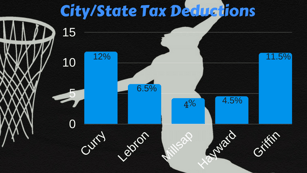

You’ll notice a large portion taken out of a player's gross salary goes towards deductions. These deductions include Escrow, Federal Taxes, City/State Taxes, Agent fees, and maximum 401k contributions. The largest differences we see between the salaries of the players we analyzed are the state and city taxes. Steph Curry has the highest state/city taxes, with 11.8% being deducted from his gross income. Whereas, Millsap has the lowest state/city taxes, with 4.2% being deducted from his gross income. Another deduction to take note of is Escrow. In the beginning of each season, 10% of the player's gross income is held in escrow. Escrow is then given back to the players as long as the owners pay the players an agreed upon percentage of Basketball Related Income.

.png?width=560&height=315&name=Copy%20of%20Blog%20Title%20%E2%80%93%20Untitled%20Design%20(1).png)

Gross Pay vs. Net Pay

City/State taxes play such a large part in determining the players take home pay. As you can see below, Steph Curry goes from being the 1st highest gross paid player to the 3rd highest net paid player. Curry’s California state taxes are to blame for this decrease in take home pay. Lebron James (Ohio) ends up taking home the highest salary due to his low city/state tax deductions.

Don't you love how you don't need to be a current or former POTUS to celebrate the holiday? The banks are closed today but we're hard at work. And we took a moment to celebrate President's Day the only way we know how to here in Payroll Country - by compiling interesting payroll and salary data about the federal government. Read on.

How much does the President make?

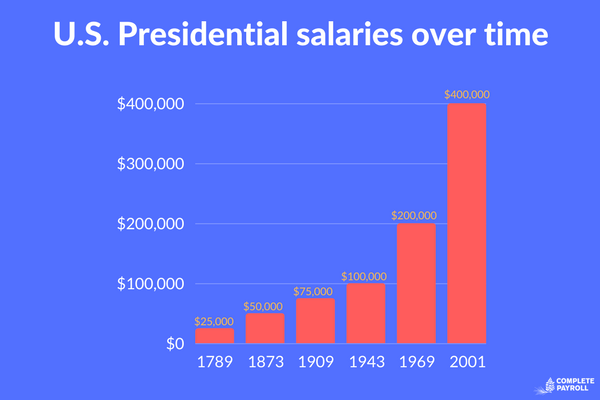

The initial salary for the President of the United States (POTUS) was set at $25,000 back in 1789. It has been raised only 5 times since then. Today, the POTUS makes $400,000 per year.

Although his term was from 1789-1797, George Washington initially took office with no official salary. Washington's salary was finally enacted on September 24, 1789, which was almost five months after he took office. Following George Washington, the idea of a fixed salary for both the president and the vice president has been consistent.

George Washington's Vice President (John Adams) and his cabinet members each earned salaries of $3,500.

How much do Supreme Court Justices make?

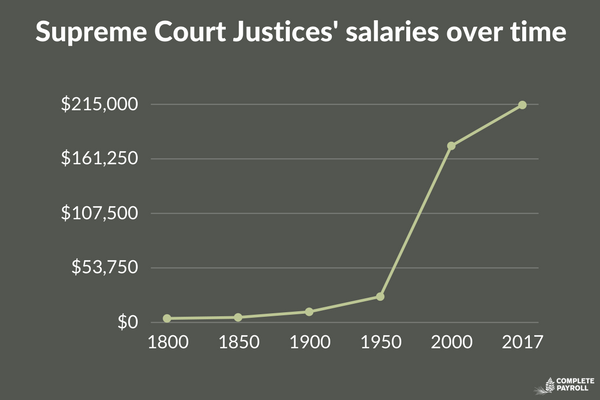

The Supreme Court has nine justices - one Chief Justice and eight other associate justices. When the salaries were initially set back in 1789, the Chief Justice earned $4,000 per year and the associate judges earned $3,500.

While the President's salary has only increased 5 times since 1789, the salaries for the Supreme Court Justices has increased 51 times over the same period. Currently, it has increased to $286,700 (Chief Justice) and $274,200 (associate judges) where it has remained since.

A Wikipedia article shows each salary increase, and adjusts each salary for inflation to show a comparison to 2016 dollars. Adjusted for inflation, the "biggest" salary a Supreme Court Chief Justice ever enjoyed was $68,800 back in 1969, which is equivalent to approximately $408,178 today.

How much do other senior US officials make?

The Vice President makes $235,100. A member of the Unites States Congress (both Senators and House Representatives) earn $174,000. Majority and Minority leaders each earn $193,400. And the speaker of the house earns $223,500.

.png?width=600&height=400&name=Current%20salaries%20of%20senior%20US%20officials%20(2).png)

The White House

According to a 2014 report from The Hill, The White House pays out a total of $37.8 million in salaries to a total of 456 employees (in Washington D.C. they're called staffers). That makes for an average salary of $82,844, although the salaries are top-heavy. The median salary is actually $70,000.

The maximum salary for White House administrative staffers (non-elected representatives that aid the President) is $180,000. At the time of this report, there were 24 employees who were earning the maximum salary.

The lowest paid salary for a White House employee was $48,000.

.jpg?width=600&height=200&name=Examining%20the%20Different%20Ways%20Doctors%20Get%20Paid%20-%20Complete%20Payroll%20(1).jpg)

Understanding the pay infrastructure of the medical industry is no easy task! There are a lot of moving parts to payroll in the medical world, and often, workers are siloed into specific areas that do not have much overlap. Money, medicine, and insurance are a messy world for outsiders to understand. A few years ago, the nonprofit media organization ProPublica developed a database where patients can look up their doctors to see if they have been paid by pharmaceutical or medical device companies. All of this data comes from federally mandated reporting of information that doctors have to provide.

Some doctors in the database have received nothing at all, or perhaps $10 or $20 here and there as reimbursement for “promotional talks, research, and consulting, among other categories.” However, there were medical providers like Dr. Stephen Burkhart, an orthopedic surgeon, who has made $65.3 million through partnerships with pharmaceutical companies.

This made us wonder, is being a doctor sort of like being a famous athlete, who gets paid not just for doing their job but also sponsorships, partnerships, and endorsements?

Ultimately, we’ve learned that no, being a doctor isn’t like being an elite athlete. The salaries of athletes vary drastically from year to year, and much of their pay comes from contracts that value certain accomplishments (namely: wins!) over simply getting the job done. On the contrary, most doctors’ main income comes from their fairly stable salaries, not from speaking engagements or research partnerships.

However, understanding how the money you pay for medical care turns into a doctor’s salary is an interesting process! Let’s look at how doctors in America get paid.

What determines a doctor’s salary?

Working in the United States is already the best way to ensure the highest potential salary for a doctor. Here in the US, we pay our doctors more than anywhere else in the world. In fact, we pay nearly double what most other similar economies pay their medical providers.

There are a lot of reasons for this, with some healthcare experts arguing that it has to do with the way that the supply of doctors is limited by medical associations. Economist Yarek Waszul writes that “the supply of doctors is tightly controlled by the number of medical school slots, and more importantly, the number of medical residencies. Those are both set by the Accreditation Council for Graduate Medical Education, a body dominated by physicians’ organizations. The United States, unlike other countries, requires physicians to complete a U.S. residency program to practice. This means that U.S. doctors get to legally limit their competition. As a result, U.S. doctors receive higher pay.”

Waszul argues that high salaries for doctors are part of the problem of high medical costs for Americans, but Gary Price, MD, and Tim Norbeck wrote a rebuttal for Forbes that argues the following:

- The way to measure the fairness of a doctor’s pay is by looking at what other careers the individual doctor could have pursued; if the person could have made just as much money by going into another high paying job like being a lawyer or being a Wall Street investor, then that person deserves equally high pay as a doctor.

- Only 20% of patient medical spending goes to doctors’ salaries.

- Many Americans do not see it as a problem for doctors to be paid very high salaries.

What are these salaries, anyway? The mean salary for medical doctors in the United States is $294,000, although specialists tend to be paid significantly more than primary care physicians and general practitioners.

Salaries for doctors tend to be affected by the same things that affect salaries for other industries: location, education, specialty level, experience, and demand.

.jpg?width=600&height=200&name=Examining%20the%20Different%20Ways%20Doctors%20Get%20Paid%20-%20Complete%20Payroll%20(2).jpg)

What is the difference in pay between independent providers and those affiliated with a network?

In 2016, a survey of medical providers showed that only 32% of 16,000 owned an independent practice. This was down from 48% of the respondents in 2012. Network-employed doctors do not have as much freedom as their colleagues who are independently employed, but they also have more job security.

A medical provider in a network does not have to compete as much for patients, and there is more flexibility in lateral moves within the network and opportunities to “climb the ladder.” Independent providers get to make more decisions about their practice, schedules, employees, and insurance plans.

With all other factors being equal, independent doctors get paid more than their salaried, group-employed colleagues. This is because they get a larger share of the practice’s earnings. However, doctors who own their own practices often have to work longer hours in order to see enough patients to make their offices profitable.

For doctors who have families, children, or important social and community commitments, this can be an unlivable arrangement. That is part of the reason why doctors are moving towards salaried employment with a hospital, network, or group.

How does Medicare participation affect a doctor’s salary?

Doctors can decide whether or not to participate in Medicare. According to Medicare Resources, “Physicians who agree to fully accept the rates set by Medicare are referred to as participating providers. They accept Medicare’s reimbursements for all Medicare-covered services, for all Medicare patients, and bill Medicare directly for covered services. Most eligible providers are in this category.

A Kaiser Family Foundation analysis found that 93 percent of non-pediatric primary care physicians were participating providers with Medicare in 2015, but only 72 percent were accepting new Medicare patients.”

Medicare involvement does affect a doctor’s income, because Medicare reimburses at a lower rate for medical care than for-profit insurance companies. If your doctor accepts Medicare, that means that she or he is willing to work for a lower rate in order to serve lower-income patients.

What about unconventional doctors who don’t take insurance?

There is one other category we need to look at: cash-only doctors.

These providers do not work with medical insurers at all. Instead, they bill the patient directly and do not accept any insurance reimbursements or plans. One such doctor is Carmela Mancini, who told Healthline, ““The main benefit of not billing through insurance is that you no longer work for the insurance company. You work directly for the patient.”

This kind of care, often called “direct care” or “direct primary care,” is nowhere near as popular as dealing with traditional insurers. According to Healthline, these providers tend to work with 800-1000 patients per practice, in contrast to traditional primary care practices that have 2000-3000 patients.

Direct primary care providers offer monthly fees for their services, or membership plans. If this is in place of insurance, the fees are typically lower than insurance costs. However, many individuals still carry insurance, even if they have a direct primary care doctor, because they need coverage for lab tests, specialist visits, medications, and more.

Doctor pay is complex

Doctors’ salaries are complex, and they are influenced by everything from where they live and work, what their specialty is, whether or not they accept Medicare, their status as a network or independent provider, and the decisions they make based on what they value and how they want to practice medicine.

With the recent rideshare approval in the New York State budget, we decided to shine a light on the payroll aspects of Uber as a company as well as its drivers. How much do Uber drivers make? How does Uber pay their drivers? Are Uber Drivers Employees or Independent Contractors? Here in Payroll Country, we are excited to answer questions like these.

What determines how much an Uber driver makes?

Essentially, Uber drivers decide how much they make on their own terms. It is important to remember that with Uber there’s no boss, no office and no set schedule, so how much an Uber driver makes isn't concrete. However, a few key factors come into play when considering the differences between each driver's salary. These determining variables include when, where and how many hours a week the Uber driver drives.

How much do Uber drivers make an hour?

On average, Uber drivers make around $19 an hour. In large urban cities, like New York City for example, the average is over $30 an hour.

How much do Uber drivers make per ride?

There is a simple formula that can be used to determine how much an Uber driver will make per ride. Fares are calculated by taking the time and distance and adding the base fare and booking fee. Booking fees are approximately 25% of the base fare.

(Distance)%20%2B%20Base%20Fare%20%2B%20Booking%20Fee%20=%20Fare%20per%20Ride.png?width=468&height=157&name=(Time)(Distance)%20%2B%20Base%20Fare%20%2B%20Booking%20Fee%20=%20Fare%20per%20Ride.png)

How does Uber pay their drivers?

Uber pays its drivers weekly through “Instant Pay." Instant Pay is Uber's version of direct deposit, where weekly fares are automatically deposited in the driver's bank account. “Instant Pay” allows drivers to transfer their current earnings to a debit card account at any time of their convenience.

Uber Drivers: Employees or Independent Contractors?

Many may wonder if Uber drivers fall into the category of employees or independent contractors.

Uber classifies their drivers as independent contractors, and here’s why...

First, the drivers have a higher degree of control. Uber drivers have no boss, no office, and no set schedule. Secondly, they are not entitled to host protections and benefits like minimum wage protection, overtime pay, meal breaks, unemployment insurance, and reimbursement of business expenses. Finally, the drivers of Uber are not entitled to payroll withholdings, including federal and state tax withholdings.

Percentage distributions of Uber Fare?

Generally, drivers keep 75% of the fare price for any given ride and Uber takes 25% of the fare. To calculate an estimate as to how much on average a driver would take home for a 30-minute ride, there are additional deductions to consider like the Rider Fee and other expenses (gas and vehicle expenses). After taking all deductions into account, the average Uber driver will generally take home $9.13 from a 30-minute ride.

What are Uber's best/busiest work hours?

Most Uber drivers would probably like to know when to schedule themselves to optimize their possible earnings. Here are the busiest work hours for Uber...

- Monday- Thursday (Mornings)

- Friday (Evening)

- Saturday (All Day)

- Sunday (Morning/Afternoon)

How do drivers with Uber pay taxes?

As discussed earlier, Uber drivers are independent contractors who are essentially running their own business. Tax from their earnings are not withheld by the state or federal government, therefore they are responsible to file taxes at the end of each year. A 1099 form is sent to each driver earning $600 or more during a calendar year. There is a new feature on the Uber app for Uber drivers to check their tax materials, tax summary, and 1099 form.

Can you be a part-time uber driver?

As mentioned earlier, a driver with Uber has a completely flexible schedule with hours determined by his or her own personal preferences. So yes, of course, one can be a part-time Uber driver. Uber is a great fit for people who are looking for temporary, seasonal, part-time, or even flexible full-time opportunities.

As reported by a national study across 20 of Uber's largest markets, 80% of Uber drivers drive fewer than 35 hours a week. More than half of Uber drivers only drive between one and 15 hours each week.

Before you sign up to deliver food on UberEATS, it’s important to understand the financial side of the business and how your paycheck will be affected by the fees you have to pay and the tips you get from customers. Let’s take a look at some of these factors that can influence your earnings as an UberEATS driver.

At Complete Payroll, we make it our priority to answer questions like these to help educate our clients; so if you would like the facts regarding UberEATS, read on!

What is UberEATS?

UberEATs is Uber's new food delivery platform that makes getting food from local restaurants as easy as clicking a button. With UberEATS customers can choose any menu item from a restaurant and drivers pick up food at the restaurant and bring the food to customers. Uber refers to UberEATS drivers as “delivery partners”. They aren’t technically employees of the company, they're contractors who are paid a contract fee depending on how many deliveries they've made.

Driver Requirements

To drive for UberEATS you must:

- Be 19 years old or older

- Have a 2 or 4-door car, motor scooter or bicycle

- Have a valid driver’s license, insurance, and proof of vehicle registration

- Submit your social security number for a background screening

Earnings per trip

According to Gridwise, the average delivery driver makes $15.84 per hour, or $9.37 per trip. But, drivers can simply do their own calculations to determine their hourly rate by factoring in how many deliveries they expect to make per hour.

Payment distribution

How are UberEATS drivers paid and how much of the total payment do they take home? UberEATS drivers are paid for each delivery based on a pickup fee, drop-off fee, and mileage fee. Below is a simple formula that can be used to calculate how much an UberEATS driver will make per ride.

An example of take home pay using Los Angeles rates: $2.50 pickup + $0.60 mileage (3 miles at $0.20/mile) + $3.00 drop off fee = $6.10. Minus Uber’s 25% fee ( $1.52) , total payout is $4.58.

When is UberEATS available?

UberEATS is subject to the operating hours of the restaurants in their partnership. Therefore, UberEATS can be available 24 hours a day, 7 days a week in very busy cities like New York City. However, to make the maximum pay as an UberEATS driver you need to work during the “Promotion Boost” hours. Pay can vary quite a bit from day to day and hour to hour, so working during the dinner and lunch rush hours or “Promotion Boost” hours will allow you to earn on the higher end of the pay scale. “Promotion Boost” works like surge pricing for Uber. Depending on time and location, drivers will receive extra pay, as a way of encouraging additional riders onto the roads.

Where in New York is UberEATS available?

UberEATS is currently available in all over the state of New York.

What restaurants can you order from? Restaurant selection varies by delivery location. Open the app to see the restaurants delivering directly to you, and check back as we continue to add new restaurants weekly.

Downsides?

To reduce delivery times, the UberEATS payment structure is designed to encourage the maximum amount of drivers on to the road as possible. However, UberEATS drivers have been undergoing a huge pay cut so less drivers feel encouraged to deliver; increasing the wait time per order. The pay for UberEATS can go below $10/hour, even lower because there is no minimum. Other drawbacks for driving for UberEATS include, traffic, parking and long restaurant waits.

Way back in 1926, “The Galloping Ghost” Red Grange signed a contract with the Chicago Bears that earned him $100,000 for the season, which lasted for 67 days. This was in a time when most players were given $100 per game, and many credit Grange with legitimizing the sport of football. Grange paved the way for the NFL to become a major force the American sports industry.

These days, people often talk about the huge salaries that are earned by NFL superstars. Those conversations reflect a pretty basic truth: there are a lot of super rich NFL stars! However, Grange shows us that this isn’t a new conversation at all. Football’s most competitive and beloved players have been making a ton of money for nearly a century.

Need some examples? Just look at the top 10 salaries for NFL players in the 2022 season:

10. Jared Goff, Detroit Lions, $33.5 million

8. Kirk Cousins, Minnesota Vikings, $35 million

Russel Wilson, Denver Broncos, $35 million

6. Dak Prescott, Dallas Stars, $40 million

Matthew Stafford, Los Angeles Rams, $40 million

5. Derek Carr, Las Vegas Raiders, $40.5 million

4. Josh Allen, Buffalo Bills, $43 million

3. Patrick Mahomes, Kansas City Chiefs, $45 million

2. Deshaun Watson, Cleveland Browns, $46 million

1. Aaron Rogers, Green Bay Packers, $50.3 million

And those are just the salaries! Players also get signing bonuses, roster bonuses, workout bonuses, and option bonuses. When you add in endorsement deals, the total take-home of the NFL’s biggest stars is pretty impressive. A lot of kids dream of making it big in the NFL, and the salary is part of that dream. High school and college athletes alike aspire to be signed to a pro team so that they can play professionally and get paid for it.

What About Everybody Else?

But what about the average NFL player’s pay and bonuses? How does the salary of a professional football player who isn’t a huge star compare to these big names?

The NFL’s Collective Bargaining Agreement that went into effect in 2020 will remain the governing document for team salaries until 2030. It sets a one-year contract for a rookie active roster player at $705,000.

According to CNBC, every year that they are on the roster and active, players are guaranteed an increase in their pay. The maximum annual increase in each of the four years of a deal is 25% of the first year cap number. That’s great news for those lucky enough to last that long in the NFL, but many won’t ring in a fourth year on the job. The average career length is less than three years, meaning most players never advance beyond the lower rungs of that payment ladder.”

Back in 2018, the LA Times ran a series debunking NFL myths. One of those myths was that everyone in the NFL is “rich.” They argued that even though the “average” salary for NFL players is $2.7 million, those major player salaries that are in the $20-30 million range inflate the average to misrepresent what ordinary pro players make.

LA Times journalist Gary Klein writes, “The NFL salary cap in the 2018 season was $167 million, divided among 53 players. If the salaries were divided evenly, that would be $3.2 million per player. The Patriots roster features three players with salary-cap numbers of $10.9 million or more. Three players earned between $6 million and $8.5 million, eight made $3 million to $5 million and 17 earned between $1 million and $3 million. Twenty-one were paid less than $1 million.”

Are the Risks the Same for All Players?

Being an NFL superstar means you have fame, long-term money-making potential, and celebrity status. However, some argue that the “average” player may be taking on a lot more risks than their more famous teammates, and for much less payoff.

Most NFL players only stay in the league for an average of 3 years. That means that young players start their careers at 22 or 23 years old and are likely to retire well before they are 30. That $705,000 starting salary sounds pretty great, but when you only have about three years of earning potential in your career, the cost/benefit analysis changes pretty significantly!

Many retired NFL players have discussed the difficulty of finding work, supporting their families, and funding their medical expenses in the years after the end of their short careers. Although there are definitely a lot of retired players who find successful careers, there is an undeniable financial strain on retired players. In fact, in 2009, there was a report that 78% of retired players declared bankruptcy or went through significant financial stress.

Every day that they practice or play, NFL players risk concussions and Traumatic Brain Injuries, as well as other injuries. Zach Binney from Football Outsiders conducted an analysis of NFL data, and he recently looked into some of the injury risks for players. He argues, “NFL injuries are complicated and difficult to predict. We've shown that a player's team, coach, and even the stadium he's playing in combine with his own injury proneness and a healthy dose of luck to determine whether he makes it through the week.”

He also questions the statistics that have been touted by the NFL that quarterbacks are experiencing fewer significant injuries than in previous years and argues that players are still being injured at similar rates, even if the numbers are calculated differently from year to year.

What does it all mean?

Ultimately, it is hard to determine who the “average” NFL player is. The only people who can really say whether or not the pay justifies the risks are the ones making that decision. Clearly, there is no shortage of athletes working hard to get drafted into the NFL, and plenty of people who would love the chance to play football for over a half-million dollars a year.

Still, when we hear people talk about all the money that is made by NFL players, it is probably a good idea to remember that there are a lot of players who aren’t becoming millionaires and that there are a lot of risks to playing one of America’s most beloved sports.

The topic of teacher compensation riles people up. Some think that all of the problems in our educational system are caused by low teacher wages. Others point to seniority-based salaries and the high cost of teacher pensions as evidence that, if anything, teachers are paid too much.

The truth is that teacher compensation varies greatly from state to state, city to city, and even from one type of school to another. Private, public, and charter schools each have models of teacher compensation that reflect the different economic realities they face.

Who’s writing the checks?

Private schools rely on tuition and donations for funding. Although there may be a teachers’ association, private schools are not unionized and salaries are negotiated on an individual basis. Some private school teachers earn more than their public school colleagues, but the average teacher does not.

Public schools receive federal, state, and local funding. Pay rates are set at the district level by collective bargaining between the teachers’ union and the district. On average, teachers at public schools earn more than teachers at charter or private schools.

Charter schools receive state but not local funding, so they are reliant on grants and donations. They typically pay less than public or private schools - collective bargaining is rare and charter schools have little incentive to pay teachers more than necessary.

Who’s being hired?

Charter schools tend to hire less-experienced teachers who turn over at a higher rate. A 2014 snapshot of the National Association for Independent Schools showed that 19% of teachers employed by member schools had 5 years of experience or less.

The U.S. Department of Education’s Schools and Staffing Survey shows a clear gap in experience and education between charter school teachers and public school teachers. Public school teachers tend to be older, more experienced and more educated.

Who benefits the most?

85% of public school teachers are enrolled in a pension plan where the payout is determined by a formula based on years of service and average salary rather than by the vagaries of the stock market. That sounds great, unless you’re trying to enter the profession.

The criticism of public school pensions is that the entire plan is designed to reward career service at the expense of entry level salaries. Beginning teachers have to earn less in order for school districts to be able to afford looming pension payments for those nearing retirement.

Teachers at charter and private schools are more likely to be enrolled in a standard 401(k) plan.

The Bottom Line

Regardless of whether the school is public, private, or charter, the topic of teacher compensation is complicated. As you bring issues like school vouchers and other forms of federal funding into the discussion, it becomes even more complex. However, taking the time to educate yourself will help you have a better understanding of this topic that impacts the people teaching future members of the workforce.

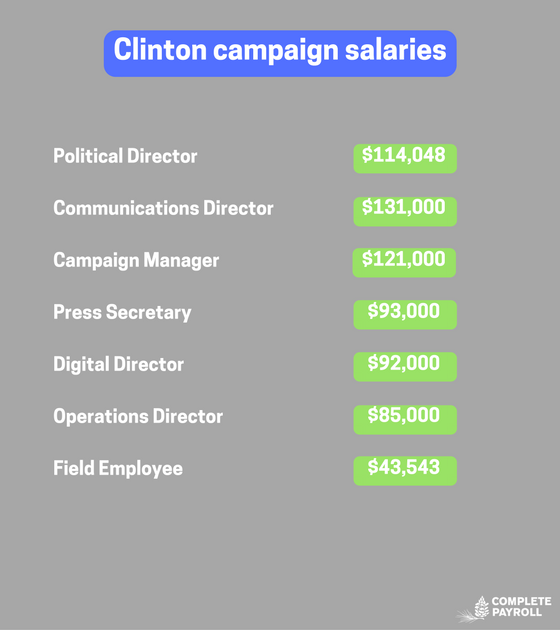

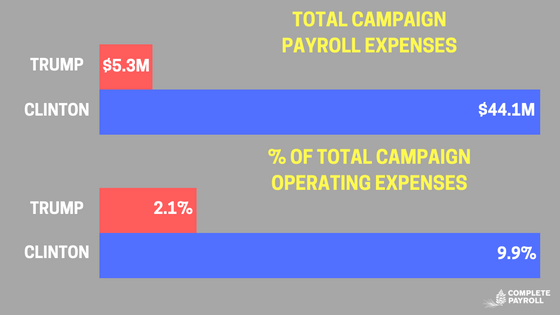

As a payroll company, we’re always interested in payroll-related data. This week, we decided to see how that applies to the payroll budgets and salaries of the Clinton and Trump campaigns in the 2016 Presidential Election.

All of these salary facts addressed in this article are estimates based on the bi-weekly paychecks reported in FEC data. Major political campaigns are required by law to report operating expenditures, including salary and payroll, to the FEC.

Total payroll

Clinton campaign: $44.1 million (9.9% of total campaign expenditures)

Trump campaign: $5.3 million (2.1% of total campaign expenditures)

Campaign budget breakdown

To better understand the Trump and Clinton's campaigns, it is important to also understand the total allocation of money. As of September 2016, Donald Trump had raised $52.9 million, spent $68.4 million, and had $34.8 million cash on hand. Hillary Clinton had raised $72.1 million, spent $80.8 million, and had $60 million cash on hand.

How many employees are on each campaign’s payroll?

Clinton campaign: over 600

Trump campaign: under 75

This does not mean the Clinton campaign is 8 times larger than the Trump campaign. On Trump’s payroll many of the salaries you’ll find on the Clinton campaign can not be found. That’s because the Trump campaign tends to outsource most of its operations to Independent Contractors, as opposed to putting them on the internal campaign payroll like the Clinton campaign.

There are benefits to both approaches. Some people would much rather be employees, because there’s less administrative work required and the employer pays a share of their taxes. On the other hard, some people would rather be independent contractors, because they tend to collect more money up front and through write-offs and other means have more control over how much they pay their taxes, and when.

Salaries of the top staffers

Clinton campaign

Amanda Renteria, Political Director - $114,048

Jennifer Palmieri, Communications Director - $131,000

Robby Mook, Campaign Manager - $121,000

Trump campaign

Kellyanne Conway, Political Director - $240,000

Stephen Bannon, CEO - undisclosed

Clinton campaign staff salaries

Clinton pays her Press Secretary, Brian Fallon, $93,000 and similarly, her Digital Director, Jenna Lowenstein, receives $92,000. Her Operations Director, Marisa McAuliffe, makes $85,000 a year. And $43,542.72 is the standard salary for one of her field employees.

Trump campaign salaries and consultant fees

Trump’s field employees make $45,554.95. And the average salary for a non-field employee is $59.307.69.

As mentioned earlier, the “missing” payroll salaries within the Trump campaign cannot be found because he has a numerous amount of consultants and contractors in place of those positions equivalent to the Clinton campaign. The campaign has a variety of consultants which perform duties like strategy, administration, finance and more.

Research Consultant- $300,000

Administrative- $300,000

Fundraising- $700,000

Communications- $900,000

Compliance- $900,000

Ballot Access Consulting- $1,500,000

Event- $1,700,000

Strategy- $1,700,000

Legal- $2,900,000

Field- $5,100,000

.png?width=560&height=630&name=Trump%20campaign%20consultants%20(1).png)

Finally, some interesting facts about these campaigns

Donald Trump has his own payroll companies, Trump Payroll Corp. and Trump Tower Commercial LLC. He pays all his staff through these companies.

The Trump campaign has spent over $850,000 alone on hats.

The Clinton campaign paid a $1,610.34 payroll expense to a man to not attend her Chicago rally. This man was known as a common "rally disruptor" and Clinton was trying to avoid any possible hindrance during her rally.

As a payroll company, we're constantly fascinated by unique aspects of compensation, especially in high-profile industries. Ever been curious about the earnings of your beloved television stars? Let's unravel the mysteries behind their salaries. Here, we present the top 5 highest-paid TV actors for a single episode, enriched with intriguing details.

1. Chris Pratt

Show: The Terminal List

Character: James Reece

Salary per Episode: $1.4 million

Years: 2022-2023

2. Elizabeth Moss

Show: The Handmaid's Tale

Character: June Osborne

Salary per Episode: $1 million

Years: 2021-2022

3. tie: Reese Witherspoon & Jennifer Aniston

Show: The Morning Show

Characters: Bradley Jackson & Alex Levy

Salary per Episode: $2 million (combined)

Years: 2021-2022

4. Norman Reedus

Show: The Walking Dead

Character Played: Daryl Dixon

Salary per Episode: $1 million

Years: 2022-2023

5. Dwayne Johnson

Show: Young Rock

Character Played: Himself

Salary per Episode: $650,000

Years: 2022-2023

Other interesting facts

Syndication

Several of these shows, like "The Morning Show" and "The Handmaid's Tale," have potential for syndication. Whenever these episodes air, the actors earn royalties. For instance, the income that Elizabeth Moss could amass from syndication is projected to be astronomical.

Lucrative Exits

In 2022, Chris Pratt emerged as the top-earning actor. His role in "The Terminal List" contributed significantly to his estimated net worth of $100 million in 2022. Interestingly, he was even paid to vacate his spot on "Guardians of the Galaxy" in 2022, with a contract buyout reported to be worth $50 million.

Persistence Wins

Most of these stars didn't begin their careers earning such staggering per-episode rates. Their income gradually increased over their career span. For instance, in 2011, Dwayne Johnson made just $150,000 per episode of "Ballers."

Conclusion

Whoever is balancing these stars' payrolls has a lot of work to do! Complete Payroll likes to leave our valued clients with some quirky yet useful information to chew on during their busy days.

All in all, every aspect of life can relate back to the business we do. Hopefully, these interesting facts cross your mind while you unwind at the end of the day to watch your favorite Primetime T.V. Shows.

In the $70 billion golf industry, salaries can make your head spin. Golf’s highest-paid player was Tiger Woods for 12 years, but that changed in 2017 when he made a mere $37 million. Injuries and endorsement losses sank Woods to number 3, behind Jordan Spieth at $52.8 million and Phil Mickelson at $50.8 million in total golf earnings.

PGA Player Pay

On the PGA Tour, Justin Thomas holds the top spot at just under $20 million in tour earnings. Jordan Spieth is second at $12.4 million, followed by Dustin Johnson at $10.2 million, Hideki Matsuyama at $8.9 million, and Jon Rahm at $7.1 million.

In the other top-20 PGA spots are golfers whose PGA earnings alone are still far ahead of the average pro golf salary of $628,000. For example, 14th-ranked Matt Kuchar brings in $4.5 million and 20th-ranked Adam Hadwin makes $3.6 million.

What about the lowest-paid players? The lowest-ranked PGA Championship contestant generally takes home around $19,000 for the tour, although the most recent last place Championship finisher, David Muttitt, received just a $3,000 payout.

In the Industry

Behind the scenes, usually off the greens, there are two million people employed in golf. It accounts for $55.6 billion in annual wages, from highly-compensated executives to minimum-wage greenskeepers.

Golf Digest studied U.S. golf careers to see how various salaries ranked in the industry. PGA pay ranked the highest, with a huge number of other golf careers earning a wide range of salaries.

Here are some examples of PGA-related non-golfer salaries:

PGA partner golfwear brand owner: Anywhere from $618,000 to $4.9 million

PGA commissioner: About $2.1 to $5.6 million

PGA chief operating officer: $1.4 to $1.9 million

PGA chief marketing officer: From $469,529 to $1.2 million

PGA senior vice president: $1.1 million

PGA executive vice president: $800,000 to $2 million

PGA of America championships officer: $744,260

PGA champions president: $595,474

PGA caddie: $161,332

PGA Tour Inc. food and beverage director: $69,633

PGA Tour Inc. accounting manager: $51,846

PGA Tour Inc. graphic designer: $32,650

Outside the PGA, salaries don’t range quite as high at the top end. Here are some salary examples from golf-industry jobs:

USGA executive director: $854,803

USGA senior managing director: $664,426

Junior association director: $538,420

Course design architect: $500,000

Foundation president: $481,317

Big-city association director: $435,461

Nationwide association superintendent: $397,915

USGA equipment managing director: $310,187

LPGA chief legal officer: $304,807

Private club general manager: About $150,000 to $300,000

University men’s head golf coach: Around $250,000

University women’s head golf coach: Around $155,000

Golf club executive chef: $142,854

Private course superintendent: $103,359

Private course director: $100,318

Public course director: $96,334

Public course general manager: $92,544

Private instructor: $82,841

Golf manufacturer sales rep: $82,418

Golf teaching professional: $53,717

LPGA caddie: $53,000

Golf shop merchandise manager: $52,003

University assistant/associate manager: About $45,000

Private club locker room assistant: $30,000, plus tips

Private course ranger: $25,000, plus playing privileges

Mower/landscaper: $18,000

Bartender or beverage cart worker: minimum wage

Golf club cleaner: minimum wage

The PGA maintains a directory of information for people interested in golf careers. Although many executive-level jobs require college degrees, the PGA points out that a love for golf and good communication skills are all that’s required for many jobs in the industry.

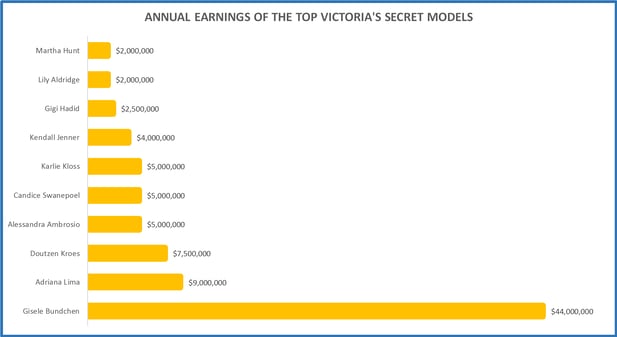

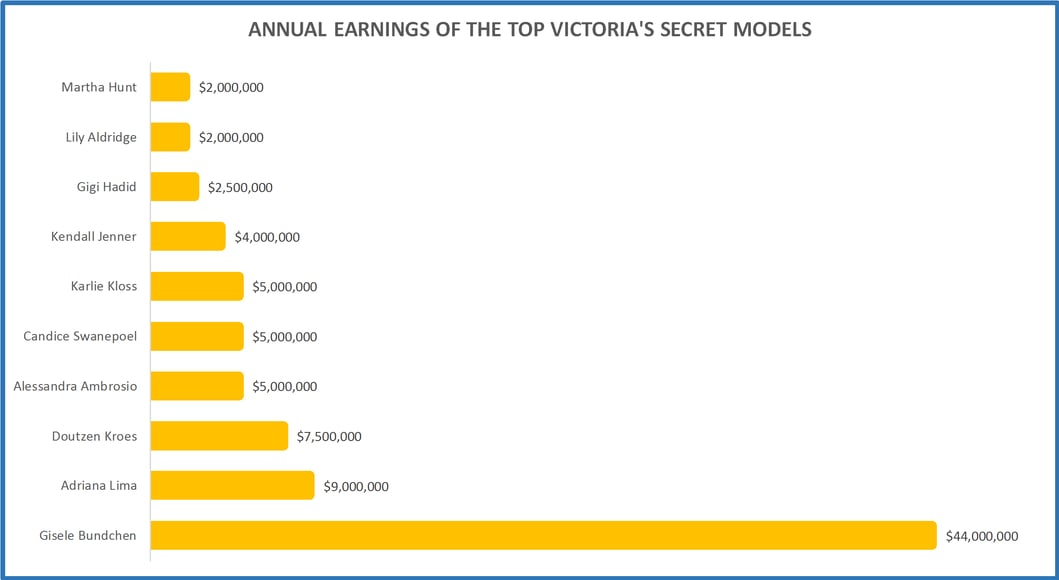

Millions of Americans tune in to watch the Victoria’s Secret Fashion Show in December every year. The production of a fashion show of this magnitude includes a significant number of paychecks being cut. So, we decided to take a deeper look into the salary and pay data of everything “Victoria’s Secret Fashion Show”. From the highest paid supermodels, to the supporting staff/production team, we’ve uncovered it all!

Average model salary

Victoria’s Secret Models are among the highest paid models in the world. These women make anywhere between $100,000-$1,000,000 a year, on average. However, the paychecks increase due to seniority and fame. Some of the most experienced models, like Gisele Bundchen and Adriana Lima, earn significantly more.

Highest paid (senior angels)

Let’s dive into the payrolls of the top 10 highest paid Victoria’s Secret Models, starting with those that receive the largest paychecks. It is important to remember that the salaries of these models are not solely from their appearance in the annual fashion show, but also from their outside fashion endorsement deals. Evidence proves that Victoria’s Secret may be turning into a supermodel launch pad to fame. The idea is for models to build their brand, increase their fame, and fatten their paychecks through endorsements and other opportunities.

Gisele Bundchen is the highest paid Victoria’s Secret model of all time. Bundchen earned an estimated $44 million in 2015 alone and has an outside deal with Under Armour. She has an estimated net worth of $386 million. Following Bundchen, we have Adriana Lima with a $9 million annual salary. Lima also has an endorsement deal with Maybelline. Doutzen Kroes is next with an annual salary of $7.5 million. Alessandra Ambrosio makes $5 million a year and has her own swim line called “Ale by Alessandra Ambrosio”. Candice Swanepoel and Karlie Kloss, also make $5 million a year.

Lower paid (newcomer angels)

The Angels bringing in the least amount of money yearly are often newcomers. Kendall Jenner, the face of Calvin Klein and Vogue, brings in about $4 million a year from her modeling career. Gigi Hadid works externally from Victoria’s Secret with CoverGirl and makes about $2.5 million annually. Lily Aldridge and Martha Hunt end off the list with $2 million each in annual earnings.

Show production

Victoria’s Secret President and CEO Sharen Turney, has disclosed that the fashion show costs an estimate of $22 million up to date. The production of the show costs about $12 million, whereas the promotion for the show is about a $10 million expense. “It’s not as much as you would think and it actually pays for itself five times over”, Turney explains. Part of the shows recuperation costs even occur during the show. With the millions of viewers tuning in to the show, CBS pays Victoria’s Secret over $1 million for the licensing of the show. Don’t forget about the commercials! Reports say that some 30-second ads cost $200,000.

Total paychecks?

The Victoria's Secret Fashion show is a massive/complex production and hundreds of paychecks get cut for each contribution. The total $12 million production cost is divvied up multiple times and trickles down into the deserving pockets. First you have the costs for the venue, staff and equipment. Victoria's Secret also has to pay the world’s best makeup artists, hair stylists, dressers, assistants, event coordinators, and security. You also have the costs of the performers that grace the stage each year alongside the Victoria’s Secret models (this year’s show includes Lady Gaga, Bruno Mars and The Weekend).

Other interesting (at least to us) facts...

- The “Million Dollar Bras” seen on the runway are actually worth millions! The Victoria’s Secret Fantasy Bras are set in 18 karat gold, 16,000 gemstones and have diamonds, rubies and sapphires. They are usually valued at $2,000,000 each.

- In 2000, Gisele Bundchen wore a bra with a $15 million price tag, which earned a place in the Guinness World Records as the most expensive item of lingerie ever created.

- Victoria’s Secret spends about $220 million a year on catalogs sent to customers.

- A majority of the Victoria's Secret payroll comes from their remarkably high seasonal sales during and following the fashion show. One-third of Victoria’s Secret’s highly-seasonal sales occur in the fourth quarter, which is the most profitable quarter. All in all, the marketing that comes from the show purposely overlaps with holiday sales.

- Victoria’s Secret revenue for the fiscal year ended January 31st 2015 was nearly $7.2 billion, with a $1.2 billion profit. Sales are trending upward: Estimates say this year’s revenue will be around $7.6 billion.

- So who exactly is Victoria after all? The Victoria’s Secret brand is named after Queen Victoria, England's 19th century monarch.

Would it surprise you to learn that all of the top 10 highest-paid professions are in the medical field? Perhaps not. But many other top-paying jobs are actually quite surprising, as you look further down the list. Here are 2018’s leading U.S. jobs, in terms of pure pay.

Advanced medical specialists

The top 10 highest-paid professions are also highly-educated medical specialists. According to U.S. News & World Report, the #1 highest-paid professionals in the U.S. are anesthesiologists at $269,600 a year.

They’re followed by surgeons, obstetrician/gynecologists, oral/maxillofacial surgeons, orthodontists, physicians, psychiatrists, pediatricians, dentists, and prosthodontists, who all make more than $168,000 a year.

It’s interesting to note that 4 of the top 10 are dental specialists. According to the Washington Post, their high pay reflects high demand for beautiful smiles and the fact that dental spending is on par with rising costs in the entire health care system.

Petroleum Engineers

Just below the big group of top docs, petroleum engineers come in at an average salary of $147,030 a year. These are the oil and gas industry experts who use technology to solve complex economic and political issues around the world.

IT Managers

Top-notch IT professionals are also high on the list. IT managers make an average of $145,740 a year to oversee computer systems, data storage, and cyber security.

Marketing Managers

The field of marketing holds high pay potential. Marketing managers, who handle promotions and strategic advertising efforts, make an average of $144,140 a year.

Lawyers

That’s right, lawyers make less than both IT managers and marketing managers. On average, lawyers make $139,880 annually, which is lower than commonly thought. Some experts attribute this to the vast number of solo practices and small firms that employ lower-paid lawyers.

Financial Managers and Advisors

Finance experts have high earning potential. Financial managers come in at $139,720 and financial advisors make $123,100 a year, on average. The two professions are quite similar, but advisors - as their name implies - tend to focus on giving advice, while managers primarily handle portfolios.

Sales Managers

Proving again that there’s money in the money biz, sales managers make about $135,000 a year. Sales managers typically oversee a staff of salespeople and build revenue for companies, with top achievers bringing in top pay.

Business Operations Managers

It’s not a flashy title, but a business operations manager makes about $122,000 a year. These high-ranking executives make strategic decisions for big enterprises, so the job typically requires a master’s degree and years of experience.

Actuaries

An actuary is essentially a risk manager. Many actuaries work for insurance companies and agencies that analyze worldwide risks and make predictions based on mathematics. Their average salary is $114,120.

Political Scientists

Political scientists, who make an average of $112,250, study the origin and operations of political systems. Political science was a growing field in the early 2000s, but pay growth is expected to slow between 2018 and 2026 due to a job market flooded with candidates.

What About Actors, Athletes, and Celebrities?

Does it seem strange that the highest-paid professionals aren’t millionaires? That’s because professions are ranked by average pay. Many high-status jobs, like acting and pro sports, don’t make the top 25, or even the top 100. Famous people are exceptionally well-paid standouts in professions that are lower in pay.

Actors, for example, make a median salary of $54,828 in 2018, varying wildly by location and type of work. The median salary of a pro athlete is just $33,507, with millionaire athletes accounting for less than 1% of all pro athletes.

See more interesting facts about U.S. employment on the Complete Payroll blog, or contact us today for a quote on HR and payroll management.

Get Instant Blog Notifications

Get Instant Blog Notifications